****************************

Update as on 30th June 2025

****************************Bought 261 shares of Karnataka Bank. The ceo exit provides a great opportunity to enter the stock at just 0.6 time current book value. At 12-13% roe it deserves at least 1 time book value multiple. So in 3 years its a 2X opportunity.

Portfolio as on 30th June 2025:

Stock Qty Avg. Price Investment

-----------------------------------------------------------------------

Selan Exploration 160 250 40000

Jindal Drilling 50 240 12000

Indusind Bank 400 700 280000

Karnataka Bank 261 196.5 51300

Cash Nil

-----------------------------------------------------------------------

Total 3,83,300

****************************

Update as on 12th March 2025

****************************Added 400 shares of Indusind bank at inr 700/share to the portfolio.

Portfolio as on 12th Mar 2025:

Stock Qty Avg. Price Investment

-----------------------------------------------------------------------

Selan Exploration 160 250 40000

Jindal Drilling 50 240 12000

Indusind Bank 400 700 280000

Cash 51,300

-----------------------------------------------------------------------

Total 3,83,300

Rationale:

#Indusind Bank has fallen over 60% from its 52 wk high of 1700 approx (microfin + derivative issue) and the problem that its facing is a lot magnitude lower than what icici bank was facing during 2015 to 2018 period and it fell top to bottom only 54% and bottomed out at 1.4 time PBV. But due to internet and the velocity of newsflow along with algo trades the stock has collapsed at such rapid pace which has stunned the participants. But its a story across the world due to tech. TSL, NVDA Bitcoin all falling 40-50% at a whim and then again goes up equally fast. This is the new normal. Leverage and Technolgy together has amplified the ferocity of movements in stocks.

With 865 book value on 1st April 2025 and at least 950 on 1st April 2026, with all the negative sentiment getting priced in next 5 months, positive reports will start flowing in. The stock should reach 950 at least by 31st July 2025 (around 4.5 months from now). Eventually the stock should start trading at 1425 (1.5 time PBV) by 30th April 2026.

****************************

Update as on 29th Aug 2022

****************************# Earned 12 Liquid bees unit till date.

# Sold 382 liquid bees unit for a cash flow of 382000

# Added 160 shares of Selan Exploration @ 250 for an investment of 40000

# Added 50 shares of Jindal Drilling @ 240 for an inv of 12000

Portfolio as on 29th Aug 2022:

Stock Qty Avg. Price Investment

-----------------------------------------------------------------------

Selan Exploration 160 250 40000

Jindal Drilling 50 240 12000

Cash 3,31,300

-----------------------------------------------------------------------

Total 3,83,300

****************************

Update as on 20th Jan 2021

****************************# Exiting all the stock positions to go 100% cash.

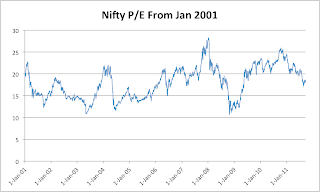

# Primary reason being the market on steroid which is exactly the opposite of what was happening in march 2020. At 40 time pe multiple based on FY-20 EPS the market is extremely overvalued and stretched. Even if we assume FY-23 Nifty EPS of 700 (almost double of FY-20), it is still trading at 20 times forward multiple.

# At mid sized bank the deposit is yielding 8% or 12.5 pe multiple while the stock market is trading at 40 times on TTM basis and 20 times on an optimistic eps assumption for FY-23 FY. I would rather keep my money in debt rather take risk on stock at current levels. Hence the cash call.

# Sold Tata Motors DVR 1600 shares @ 106 thereby generating a cash of 1,69,600 /-

# Bought 170 liquid bees at 1000 each.

# Total portfolio stands at 3,71,300/-

Portfolio as on 20th Jan 2021:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Liquid Bees 370 1000 370,000

Cash 1,300

-----------------------------------------------------------------------

Total 3,71,300

****************************

Update as on 7th Jan 2021

****************************Updating the model portfolio after a big gap pf almost 1.5 years and there has been dramatic moves in stock markets across the world during that time. The pandemic made everyone felt that the world is coming to an end but things stabilized after some time and we are starring at all time highs in all the markets globally. The stimulus packages across the world to soften the impact of covid on economy is creating a downward pressure on currencies across the world and that is fueling inflation in all the commodities.

It was the first time in history that Crude oil futures contract went into negative (-40) in march 2020 which essentially meant that producers were paying for you to hold the stock. That was unprecedented. By the end of the year things reversed 180 degree and commodities are witnessing massive inflation.

One such commodity stock is in our portfolio which is tata steel and steel prices being at all time high, the sentiment is very bullish on the stock. Hence to cash the euphoria, the holding in tata steel is being vacated. Also selling ongc at loss since the company has started making losses due to mismanagement, high debt, low gas prices etc. Since govt revenue is under pressure, likely OFS issues and capital raising will keep the stock under pressure.

# Sold Tata steel 200 shares at 720 thereby generating a cash of 144000 and profit of 75000, a return of 108% in 1.5 years.

# Sold ONGC 500 shares at 98 thereby generating a cash of 49000 and a loss of -15500.

# Purchased liquid bees worth 2 lacs

Portfolio as on 7th Jan 2020:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

TMDVR^ 1600 93 148,800

Liquid Bees 200 1000 200,000

Cash 1,700

-----------------------------------------------------------------------

Total 3,50,500

^ Tata motors dvr is kept intact as this appears to be the most undervalued stock in cnx 500. Due to brexit, pandemic and massive fall in CV sales in India, the DVR stcok went to a low of around 29 in march 2020. At that time the market panicked and discounted bankruptcy for the stock. But with all the cost cutting measures undertaken and significant improvement in local PV sales along with expectation of good FY-22 sales in CV and PV, the company is expected to do at least 35000 crores of operating profit on consolidated basis which value the company at 0.87 time OP at cmp of Rs. 80. That is absurd valuation and beyond my understanding as to why such kind of valuation is given to a company which is generating over $40 billion sales, employs over 80000 people and is a significant company of Tata Stable. Governance, scope of electrification should itself give much higher OP multiples in future.

so even if we discount OP multiple of 2 times next year then the DVR stock must be valued at Rs 183 on very conservative basis on the expanded equity shares of 382 crore shares after capital infusion by Tata Sons.

****************************

Update as on 17th Sep 2019

****************************## Sold PSB 1000 Shares @ 20 thereby taking a loss of Rs. 18000

## Sold Suryalaxmi Cotton 600 Shares @ 22 thereby taking a loss of Rs. 27000

## Sold Idea 1000 Shares @ 5 thereby taking a loss of Rs. 37000

## Sold 400 Shares of Goldiam at 117 thereby making a profit of 20000

## Earned 2 units of Liquid bees on 100 units of holding worth 2000

## Sold 102 Liquid Bees worth RS. 1,02,000

## Bought Tata Steel 200 shares at 345

## Bought Tata Motors DVR 800 shares at 56

## Bought 500 shares of ONGC at 129

## Total Cash Generated from Selling is Rs 1,87,000

## Total Cash used in purchasing new shares is 178300

Portfolio as on 17th Sep 2019:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

ONGC 500 129 64,500 TMDVR 1600 93 148,800

Tata Steel 200 345 69,000

Cash 8,700

-----------------------------------------------------------------------

Tata Steel 200 345 69,000

Cash 8,700

-----------------------------------------------------------------------

Total 2,91,000

** The Portfolio churn has reduced the networth at cost by roughly 16% since 7th March 2019. Exposure to large global stocks should make up for the losses in coming months. Midcaps and small caps might have bottomed out but lack of confidence, recent memory of bloodbath and poor income growth due to economic turmoil will keep their prices in check and investors are not going to bid up and buy in hurry except selective stories. Hence the exposure has been entirely shifted to undervalued large caps.

****************************

Update as on 7th March 2019

****************************## Sold Balrampur Chini Mills 1000 Shares @ 140 thereby making a profit of 65500

## Bought Tata Motors DVR 400 Shares @ 95 bringing down the average price to 130.

## Cash residual used to purchase Liquid Bees 100 units for Rs. 1,00,000

Portfolio as on 7th March 2019:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

PSB 1000 38 38,000 Goldiam 400 67 26,800

TMDVR 800 130 104,000

Suryalaxmi 600 57 34,200

Idea 1000 42 42,000

Liquid Bees 100 1000 100,000

Cash 2,189

-----------------------------------------------------------------------

TMDVR 800 130 104,000

Suryalaxmi 600 57 34,200

Idea 1000 42 42,000

Liquid Bees 100 1000 100,000

Cash 2,189

-----------------------------------------------------------------------

Total 3,47,189

****************************

Update as on 24th Sep 2018

****************************Allocating cash further to reduce cost of our holdings after massive panic correction.

## Bought Balrampur Chini Mills 500 Shares @ 75

## Bought Tata Motors DVR 200 Shares @ 128

## Bought Suryalakshmi Cotton Mills 300 Shares @ 44

## Bought Idea Cellular 1000 Shares @ 42

## Earned Roughly 3 units of Liquid Bees on 115000 Since April.

## Sold 118 units of Liquid Bees worth 118000.

Portfolio as on 24th Sep 2018:

Stock Qty Avg. Price Investment

PSB 1000 38 38,000

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Balram chini 1000 74.5 74,500PSB 1000 38 38,000

Goldiam 400 67 26,800

TMDVR 400 165 66,000

Suryalaxmi 600 57 34,200

Idea 1000 42 42,000

Cash 189

-----------------------------------------------------------------------

TMDVR 400 165 66,000

Suryalaxmi 600 57 34,200

Idea 1000 42 42,000

Cash 189

-----------------------------------------------------------------------

Total 2,81,689

****************************

Update as on 12th April 2018

****************************Allocating cash to buy some beaten down names after decent correction since the portfolio was liquidated.

## Bought Balrampur Chini Mills 500 Shares @ 74

## Bought Punjab Sind Bank 1000 Shares @ 38

## Bought Goldiam International 400 Shares @ 67

## Bought Tata Motors DVR 200 Shares @ 202

## Bought Suryalakshmi Cotton Mills 300 Shares @ 70

## Earned Roughly 5 units of Liquid Bees on 273000 till date.

## Sold 163 units of Liquid Bees worth 163000.

Portfolio as on 12th April 2018:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Balram chini 500 74 37,000PSB 1000 38 38,000

Goldiam 400 67 26,800

TMDVR 200 202 40,400

Suryalaxmi 300 70 21,000

Liquid Bees 115 1000 115,000

Cash 489

-----------------------------------------------------------------------

TMDVR 200 202 40,400

Suryalaxmi 300 70 21,000

Liquid Bees 115 1000 115,000

Cash 489

-----------------------------------------------------------------------

Total 2,78,689

****************************

Update as on 13th Nov 2017

****************************Liquidating the entire portfolio and sitting on sideline for opportunities after a decent correction.

## Sold Bharti Airtel 150 Shares @ 500

## Sold Majesco 100 Shares @ 524

## Sold Mindtree 100 Shares @ 504

## Sold HGS 50 Shares @ 560

## Sold Sunpharma 75 Shares @ 535

## Sold Coal India 100 Shares @ 275

Portfolio as on 13th Nov 2017:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

LiquidBees 273 2,73,000Cash 689

-----------------------------------------------------------------------

Total 2,73,689

The portfolio witnessed 22% appreciation in just 3 months which suggest the kind of euphoria getting built in the stock markets. It was not expected when I picked stocks just 3 months back. This appreciation is not bcoz of my superior stock picking skills but bcoz of benign environment. From portfolio standpoint there are no good opportunities easily available at these levels and hence taking a call on sitting on 100% cash. It seems globally a significant correction is imminent as the markets across the world have been running as if there is no tomorrow and ignoring all the potential risk. Staying invested is mutual funds mandate but retail shareholders have the choice and flexibility to stay on cash when nothing is worth buying.

****************************

Update as on 10th Aug 2017

****************************Utilizing the sharp fall in Sun Pharma and Coal India to allocate cash in the portfolio.

## Bought Sunpharma 75 Shares @ 460

## Bought Coal India 100 Shares @ 240

Portfolio as on 10th Aug 2017:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Bharti Airtel 150 344 51,600Majesco 100 385 38,500

Mindtree 100 448 44,800

HGS 50 588 29,400

Sun Pharma 75 460 34,500

Coal India 100 240 24,000

Cash 264

-----------------------------------------------------------------------

HGS 50 588 29,400

Sun Pharma 75 460 34,500

Coal India 100 240 24,000

Cash 264

-----------------------------------------------------------------------

****************************

Update as on 7th April 2017

****************************Restarting the portfolio with some names where significant opportunities are emerging.

Bharti Airtel: After all the scare that RJIO created in the telecom market, I believe the strongest player will only get stronger from here onwards. Bharti Airtel is the last to fall if competitive intensity carry on at the same pace. In this along with the sector govt revenue is also getting impacted. Hence some sanity should come to this space and should make very good return in next 2 years.

Majesco: A U.S based P&C insurer trading at EV less than sales while its nearest competitor guidewire trades at many times sales. I expect it to generate multibagger returns in 2 years if management continue to make deal wins from large insurers.

Hinduja Global: The stock is trading at roughly one third EV to sales based on FY-18 numbers.

Mindtree: One of the best mid tier IT services company. I expect in next 12 months the policy related issues in U.S will get largely over and the stock should start commanding at least 16-18 PE multiples on FY-19 earnings.

## Earned Rs. 3000 on our Liquid bees investments in 4 months. Sold all the holdings in Liquid Bees

## Bought Bharti Airtel 150 shares at 344

## Bought Majesco 100 shares at 385

## Bought Mindtree 100 shares at 448

## Bought Hinduja Global 50 shares at 588

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Bharti Airtel 150 344 51,600Majesco 100 385 38,500

Mindtree 100 448 44,800

HGS 50 588 29,400

Cash 58,764

-----------------------------------------------------------------------

HGS 50 588 29,400

Cash 58,764

-----------------------------------------------------------------------

Total 2,23,064

****************************

Update as on 1st Dec 2016

****************************Considering the headwinds in terms of chaotic demonetization and its likely impact on growth along with GST rollout which is likely to be negatively impacting the GDP in short term, the portfolio is being liquidated to stay in cash for some time.

Also there are many events lined up such as Italian Referendum, U.S rate hike, and the impact of GAAR being applicable from 1st April 2017. FIIs did almost 20000 crores of selling in the month of Nov in equities and similar amount in debt as well. All these things are pointing towards either a correction or a lack luster market for next 5-6 months.

So in my view Fixed Income is relatively safer place to park money at this point of time from the risk-reward perspective.

## Sold Idea cellular 400 shares at 74 resulting in loss of Rs.3200

## Sold Bharti Airtel 50 shares @ 316 resulting in loss of Rs. 1600

## Sold BOI 300 shares at @ 116 resulting in loss of Rs. 5700

## Sold Mastek 200 shares @ 142 resulting in gain of Rs. 2400

## Sold L&T Infotech 50 shares @ 650 resulting in gain of Rs. 1700

## Sold Selan Exploration 100 shares at 193 resulting in gain of Rs. 300

## Sold ITC 100 shares @ 233 resulting in gain of Rs. 700

## Sold Ambuja Cements 100 shares @ 207 resulting in gain of Rs. 1200

## Sold Sun Pharma 20 Shares at 720 resulting in gain of Rs. 600

## Bought Liquid Bees 200 at 1000

The above transactions resulted in loss of Rs. 3600 and the net portfolio is having only Liquid Bees worth 2 lakhs and cash Rs. 20,064.

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Liquid Bees 200 1000 2,00,000

Cash 20,064

-----------------------------------------------------------------------

****************************

Update as on 22nd Nov 2016

****************************## Bought ITC ltd 100 shares @ 226

## Bought Ambuja Cements 100 shares @ 195

## Bought Sun Pharma 20 shares @ 690

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Idea Cellular 400 82 32,800 Bharti Airtel 50 348 17,400

BOI 300 136 40,800

Mastek 200 130 26,000

L&T Infotech 50 616 30,800

Selan Exp 100 190 19,000

ITC 100 226 22,600

Ambuja 100 195 19,500

Sun Pharma 20 690 13,800

Cash 964

-----------------------------------------------------------------------

L&T Infotech 50 616 30,800

Selan Exp 100 190 19,000

ITC 100 226 22,600

Ambuja 100 195 19,500

Sun Pharma 20 690 13,800

Cash 964

-----------------------------------------------------------------------

Total 2,23,664

****************************

Update as on 06th Oct 2016

****************************## Sold Cairn India 50 shares @ 228.5 thereby generating a gain of Rs. 1100

## Bought Mastek Ltd 200 shares @ 130

## Bought L&T Infotech 50 shares @ 616

## Bought 100 Selan exploration 100 shares @ 190

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Idea Cellular 400 82 32,800 Bharti Airtel 50 348 17,400

BOI 300 136 40,800

Mastek 200 130 26,000

L&T Infotech 50 616 30,800

Selan Exp 100 190 19,000

Cash 56,864

L&T Infotech 50 616 30,800

Selan Exp 100 190 19,000

Cash 56,864

-----------------------------------------------------------------------

Total 2,23,664

## Mastek Ltd is trading at a valuation equivalent to cash and investment (13% stake in Majesco). The company is focused on IT services now and should do well going forward as Mastek 4.0 matures and clients get results. Its U.S subsidiary Digility has started generating business and the co. is looking to acquire a small to mid sized IT service co. in U.S to reestablish its position in the worlds largest IT market.

## L&T Infotech is probably the cheapest mid sized IT service company in India and is trading at roughly 10 times FY-18 EPS

## Cairn India is replaced by Selan Exploration which is also in to oil production but is a much smaller player compared to cairn India. However the company is cash rich and worst of oil fall seems to be behind the company. With huge 2p reserves the company has potential to generate significant cash flow going forward.

****************************

Update as on 02nd Sep 2016

****************************## Utilized sharp fall in Idea Cellular as the stock has now reached very attractive valuations. Bought 400 shares at 82 thereby making an investment of Rs. 32800

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Idea Cellular 400 82 32,800 Cairn 50 206.55 10,327

Bharti Airtel 50 348 17,400

BOI 300 136 40,800

Cash 1,21,237

-----------------------------------------------------------------------

Total 2,22,564Couple of points:

1. Market has panicked about Bharti And idea cellular while the major impact of JIO launch will be on Uninor, Videocon, Aircel & Rcom. Excluding Bharti, Idea and Vodafone there are 400 million connection which would get impacted first.

2. JIO is actually protecting ARPU and targatting 500 bucks a month from each user. If it happen it will be a god send opportunity for incumbent operators as their ARPUs also goes up.

3. In 5 years time there will be at max 4 large players with all marginal players consolidated and a very strong industry with all the characteristics of an excellent business like consumption item, significant cash flow, very high entry barrier etc.

****************************

Update as on 31st Aug 2016

****************************## Utilized sharp rally in Reliance Capital to book profits. Sold 30 shares at 535 thereby making a gain of Rs. 2250

## Cash Level increased by Rs. 16,050 taking total cash in portfolio to Rs. 1,54,037

Stock Qty Avg. Price Investment

Bharti Airtel 50 348 17,400

BOI 300 136 40,800

----------------------------------------------------------------

Cairn 50 206.55 10,327Bharti Airtel 50 348 17,400

BOI 300 136 40,800

Cash 1,54,037

-----------------------------------------------------------------------

Total 2,22,564

****************************

Update as on 19th Aug 2016

****************************## Utilized sharp rally in Cairn India to re-balance the portfolio. Sold 300 shares at 212 thereby making a gain of Rs. 1635

## Cash Level increased by Rs. 63,600 taking total cash in portfolio to Rs. 1,37,987

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 50 206.55 10,327

Bharti Airtel 50 348 17,400

R Capital 30 460 13,800

BOI 300 136 40,800

Cash 1,37,987

BOI 300 136 40,800

Cash 1,37,987

-----------------------------------------------------------------------

Total 2,20,314Note: Market is highly exuberant on the back of foreign liquidity which is making many stocks in the market very expensive. Staying 100% invested in this kind of market leaves no room for margin of safety and hence will wait for correction to dabble into stocks which we like as a business and are comfortable paying the price. Staying invested at current levels might give us a max of 10% return over next one year on index level but the risk on the downside is quite large in case something goes wrong globally or locally.

In terms of local risk, the risk to inflation is slowly beginning to reemerge which will get exaggerated if crude moves to $60 by the end of this year. This is turn will put pressure on our currency which could depreciate to 70+ in a year's time as most of the world is facing deflation and U.S is having less than 2% inflation while we are having more than 6%. Earnings have been largely disappointing for 9th quarter in a row and is expected to stay weak in Q2 as well thereby pulling down the eps estimate once again for FY-2017. With all the good news being priced in the stock prices today, it doesn't make sense to buy the euphoria. As value investor it's always the other way round. We buy the fear and sell the greed.

As on 19th Aug the model portfolio (at market price) has delivered over 115% of absolute return since 21st March 2013 (portfolio start date with Rs. 1 lakh capital) while Nifty has delivered 52% return since then. Since we have already outperformed the market significantly we will wait on the sidelines for sometime before market gives us an opportunity to utilize cash in our portfolio.

****************************

Update as on 14th July 2016

****************************## Sold Exide 100 shares at 182 resulting in a loss of Rs. 300

## Sold Adani Ports 100 shares at 218 resulting in a gain of Rs. 3600 (Gain of around 20%)

## Cairn India went ex-dividend (Rs. 3 per share) in early July resulting in gain of Rs.1050

## Net Portfolio stands increased by Rs.4350 to Rs. 2,18,679

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

R Capital 30 460 13,800

BOI 300 136 40,800

Cash 74,387

BOI 300 136 40,800

Cash 74,387

-----------------------------------------------------------------------

Total 2,18,679

Update as on 18th May 2016

****************************## Sold JK Paper 200 shares at 52 realizing gains of Rs.3600 (53% profit in 14 months)

## Added 100 additional shares of BOI @ 84 thereby bringing down the avg cost to 136

## Added Adani Ports 100 shares at 182

## Net Portfolio stands increased by 3600 to Rs. 2,14,329

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

R Capital 30 460 13,800

Exide 100 185 18,500

BOI 300 136 40,800

Adani Ports 100 182 18,200

Cash 33,337

-----------------------------------------------------------------------

Exide 100 185 18,500

BOI 300 136 40,800

Adani Ports 100 182 18,200

Cash 33,337

-----------------------------------------------------------------------

Total 2,14,329

****************************

Update as on 21st April 2016

****************************## Sold Hindalco 300 shares at 104 realizing gains of Rs.9000 (40%+ gain in 5 months)

## Cash position increased to Rs. 49537

## Net Portfolio stands increased by 9000 to Rs. 2,10,727

Net Portfolio as on 21st April 2016 stands as below:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

R Capital 30 460 13,800

Exide 100 185 18,500

BOI 200 162 32,400

JK Paper 200 34 6,800

Cash 49,537

-----------------------------------------------------------------------

Exide 100 185 18,500

BOI 200 162 32,400

JK Paper 200 34 6,800

Cash 49,537

-----------------------------------------------------------------------

Total 2,10,729

*******************************

Update as on 21st March 2016

***********************************************************

Update as on 12th Jan 2016

****************************## Sold Sun Pharma 35 shares at 791 realizing gains of Rs.2590

## Bought bank of India 100 shares at Rs. 104 bringing the average cost of holding of 200 shares down to Rs. 162

## Cash position increased to Rs. 18337

Net Portfolio as on 12th Jan 2016 stands as below:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

R Capital 30 460 13,800

Exide 100 185 18,500

BOI 200 162 32,400

JK Paper 200 34 6,800

Hindalco 300 74 22,200

Cash 18,337

-----------------------------------------------------------------------

Exide 100 185 18,500

BOI 200 162 32,400

JK Paper 200 34 6,800

Hindalco 300 74 22,200

Cash 18,337

-----------------------------------------------------------------------

Total 2,01,729

****************************

Update as on 23rd Nov 2015

****************************## Bought Sun Pharma 35 shares at 717 worth ==> Rs. 25,095

## Bought Hindalco Industries 300 shares at 74 worth ==> Rs. 22,200

## Sold Reliance Capital 10 Shares at 410 worth ==> Rs.4,100 (Incurring a loss of Rs. 500)

Net Portfolio as on 23rd Nov 2015 stands as below:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

R Capital 30 460 13,800

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Sun Pharma 35 717 25,095

Hindalco 300 74 22,200

Cash 1,052

-----------------------------------------------------------------------

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Sun Pharma 35 717 25,095

Hindalco 300 74 22,200

Cash 1,052

-----------------------------------------------------------------------

Total 1,99,139

****************************

Update as on 19th Oct 2015

****************************

## Due to massive short covering and more than 35% appreciation in 2 weeks, Tata Motors is expected to stay sideways. Hence sold all the shares for the time being. Rcom is expected to report average set of numbers hence booking profit in that scrip as well.## Sold Tata Motors 62 shares at 383 thereby generating a profit of around Rs.5000

## Sold Rcom 250 shares at 82 giving the portfolio a gain of 2500 bucks.

Net Portfolio as on 19th Oct stands as below:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

R Capital 40 460 18,400

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Cash 44,247

-----------------------------------------------------------------------

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Cash 44,247

-----------------------------------------------------------------------

Total 1,99,639

****************************

Update as on 24th Sep 2015

****************************

## Swift market correction and FII's relentless selling of companies doing badly in operational performance in-spite of highly compelling valuations has led to significant price damage in some of the stocks of our portfolio.

## Done a bit of reshuffling in the portfolio to adjust some concentration risk and also to utilize significant value emerging in Tata Motors.

## Sold 80 shares of Cairn India at Rs. 150 incurring a loss of Rs. 4524 (releasing Rs.12000 cash)

## Sold 50 Rcom at Rs. 64.5 incurring a loss of Rs. 375 (releasing Rs.3225 cash)

## Sold Reliance Capital 10 shares at 354 incurring a loss of Rs. 1060 (releasing Rs.3540 cash)

## Bought Tata Motors 62 shares at Rs. 303 with the cash released from above shares.

Net Portfolio as on 24th Sep stands as below:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 350 206.55 72,292

Bharti Airtel 50 348 17,400

Rcom 250 72 18,000

R Capital 40 460 18,400

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Tata Motors 62 302.65 18,765

-----------------------------------------------------------------------

R Capital 40 460 18,400

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Tata Motors 62 302.65 18,765

-----------------------------------------------------------------------

Total 1,92,157

Note the portfolio is reduce to Rs 1,92,157 from Rs. 1,98,120 last reported due to cumulative losses (Rs. 5959) taken (as shown above) to accommodate Tata Motors in the portfolio.

****************************

Update as on 9th June 2015

****************************

## Sold ONGC 100 shares at 303 (at loss) to acquire additional 180 shares in Cairn India at 172 (for 30960) as the stock has become very attractive due to panic selling. Also not to over allocate to a particular sector, ONGC is being replaced with Cairn India.## Net holding in Cairn India stands at 430 shares at avg price of 206.5

Net portfolio as on 9th June 2015:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 430 206.55 88,820

Bharti Airtel 50 348 17,400

Rcom 300 72 21,600

R Capital 50 460 23,000

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

-----------------------------------------------------------------------

R Capital 50 460 23,000

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

-----------------------------------------------------------------------

Total 1,98,120

Note: The portfolio value at cash is reduced by 4700 bucks due to loss taken on ONGC for buying the Cairn India shares.

Note: The portfolio value at cash is reduced by 4700 bucks due to loss taken on ONGC for buying the Cairn India shares.

****************************

Update as on 25th May 2015

****************************

## Bought additional Cairn India 130 shares at 195 bringing down the average cost of holding for 250 shares to approx. Rs. 231.5. Cairn India has declared a dividend of 4 bucks per share to be ex-div on 8th July 2015.## Net residual cash after the above purchase remains at 650 bucks.

****************************

****************************

Detailed Annual Performance Review of Model Portfolio Vs Nifty****************************

Update as on 12th March 2015

****************************

Booking profits in NTPC & Tata Global and allocating some additional cash to stock.

## Sold NTPC 100 shares at 160 thereby booking gain of Rs.2000

## Sold Tata Global 100 shares at 160 thereby booking gain of Rs.500

## Bought ONGC additional 50 shares at 308 ==> Rs. 15400 (Avg cost of 100 shares now 350 bucks)

## Bought Bank of India 100 shares at 220 ==> Rs. 22000

## Bought JK Paper 200 shares @ 34 ==> Rs.6800

TOTAL PORTFOLIO at COST INCREASED by RS. 2500 TO RS. 2,02,820

Net portfolio as on 12th March 2015:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 120 271 32,520

ONGC 100 350 35,000

Bharti Airtel 50 348 17,400

Rcom 300 72 21,600

R Capital 50 460 23,000

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Cash 26,000

Rcom 300 72 21,600

R Capital 50 460 23,000

Exide 100 185 18,500

BOI 100 220 22,000

JK Paper 200 34 6,800

Cash 26,000

-----------------------------------------------------------------------

Total 2,02,820

*Note: The new scrips added in the portfolio above is highlighted in yellow shades.

****************************

Update as on 6th Feb 2015

****************************

Utilizing the opportunity to accumulate stocks that have come down sharply and trading at attractive valuations.## Bought RCom 300 Shares @ 72 ==> Rs. 21600

## Sold Idea Cellular 100 shares @ 155 thereby booking gain of Rs.1500. (Basically the stock is replaced by Rcom as it is relatively more attractively priced and is least impacted by the upcoming auction.)

## Sold HCL Tech 20 shares at 1960 thereby booking gains of Rs. 9500 (massive gain of 32% in 1.5 months)

## Bought Reliance Capital 50 shares at 460 ==> Rs. 23000

## Bought Exide Industries 100 shares at 185 ==> Rs. 18500

## Bought NTPC 100 shares @ 140 ==> Rs.14000

TOTAL PORTFOLIO at COST INCREASED by RS. 11000 TO RS. 2,00,320

Net portfolio as on 6th Feb 2015:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 120 271 32,520

Tata Global 100 155 15,500

ONGC 50 392 19,600

Bharti Airtel 50 348 17,400

Rcom 300 72 21,600

R Capital 50 460 23,000

Exide 100 185 18,500

NTPC 100 140 14,000

Cash 38,200

Bharti Airtel 50 348 17,400

Rcom 300 72 21,600

R Capital 50 460 23,000

Exide 100 185 18,500

NTPC 100 140 14,000

Cash 38,200

-----------------------------------------------------------------------

Total 2,00,320

Note: The new scrips added in the portfolio above is highlighted in yellow shades.

****************************

Update as on 15th Dec 2014

****************************

Market has witnessed 5% correction from the top and some stocks have been battered significantly. Utilizing this opportunity to nibble some quality names.Bought Cairn India 60 shares at 240.5 ==> Rs.14,430 (averaging the cost of existing shares by half)

Bought Idea Cellular 100 shares at 140 ==> Rs. 14,000

Bought HCL Tech 20 shares at 1485 ==> Rs. 29,700

Bought Bharti Airtel 50 shares at 348 ==> Rs.17,400

Net portfolio as on 15th Dec 2014:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 120 271 32,520

Tata Global 100 155 15,500

ONGC 50 392 19,600

Idea Cellular 100 140 14,000

HCL tech 20 1485 29,700

Bharti Airtel 50 348 17,400

Idea Cellular 100 140 14,000

HCL tech 20 1485 29,700

Bharti Airtel 50 348 17,400

Cash 60,600

-----------------------------------------------------------------------

Total 1,89,320

****************************

Update as on 18th Nov 2014

****************************

Profit booking in some of the stocks that witnessed sharp run-up in prices.Sold Reliance Capital 60 shares at 521 resulting in gain of Rs.3600

Sold Rcom 200 shares at 113 resulting in gain of Rs.3400

Sold ITC 50 shares at 368 resulting in gain of Rs.1000

Sold Bank Of India 80 shares at 290 resulting in gain of Rs.4000

Sold NTPC 100 shares at 146 resulting in gain of Rs.1000

Bought ONGC 50 shares at 392 ==> Rs.19600

Net gain from portfolio selling shares = Rs.13000

Net portfolio as on 18th Nov 2014:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 60 301.5 18,090

Tata Global 100 155 15,500

ONGC 50 392 19,600

Cash 136,310

-----------------------------------------------------------------------

Total 1,89,320

Note: Due to the market being overbought and global situation appearing a bit jittery, keeping a large portion of portfolio in cash (~70%) to be deployed on correction.

****************************

Update as on 14th Oct 2014

****************************

Utilizing sharp appreciation in some stocks of the portfolio.

Sold SAIL 400 at 77 resulting in gain of Rs.3600 (around 13% in 15 days)

Sold Spice Jet 1000 shares at 15.3 resulting in gain of Rs. 2500 (around 20% gain in 6 days)

Bought 50 ITC at 348 ==> Rs. 17400

Net portfolio as on 14th oct 2014:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

Cairn 60 301.5 18,090

Rel Capital 60 461 27,600

Rcom 200 96 19,200

Bank India 80 250 20,000

NTPC 100 136 13,600

Tata Global 100 155 15,500

ITC 50 348 17,400

ITC 50 348 17,400

Cash 44,930

-----------------------------------------------------------------------

Total 1,76,320

****************************

Update as on 7th Oct 2014

****************************

Utilizing further correction in select stocks in deploying residual cash in portfolio.Bought 1000 shares of Spice Jet at 12.80 ==> Rs. 12800

Bought Cairn India 30 shares at 293 ==> Rs. 8790 (averaging the cost per share to 301.5)

Reliance Capital 20 shares at 443 ==> Rs. 8860 (averaging the cost per share to 461)

Net portfolio as on 7th oct 2014:

Stock Qty Avg. Price Investment

----------------------------------------------------------------

SAIL 400 68 27,200

Cairn 60 301.5 18,090

Rel Capital 60 461 27,600

Rcom 200 96 19,200

Bank India 80 250 20,000

NTPC 100 136 13,600

Tata Global 100 155 15,500

Spicejet 1000 12.8 12,800

Spicejet 1000 12.8 12,800

Cash 16,170

-----------------------------------------------------------------------

Total 1,70,220

****************************

Update as on 25th Sep 2014

****************************

Market presented excellent opportunity to buy some some stocks at attractive valuations. Following are the stocks which were added to the portfolio today.

SAIL 400 @ 68 ==> Rs. 27,200

Cairn India 30 @ 310 ==> Rs. 9300

Reliance Capital 40 @ 470 ==> Rs. 18800

RCom 200 @ 96 ==> Rs. 19200

Bank Of India 80 @ 250 ==> 20000

NTPC 100 @ 136 ==> Rs.13,600

Net portfolio as on 25th Sep 2014:

Stock Qty Price Investment

----------------------------------------------------------------

SAIL 400 68 27,200

Cairn 30 310 9,300

Rel Capital 40 470 18,800

Rcom 200 96 19,200

Bank India 80 250 20,000

NTPC 100 136 13,600

Tata Global 100 155 15,500

Cash 46,620

-----------------------------------------------------------------------

Total 1,70,220

****************************

Update as on 2nd Sep 2014

****************************

Sold Cairn India 100 shares at 335 yielding a profit of Rs.2300

Sold M&M Fin 100 shares at 282 yielding a profit of Rs.4400

Bought Tata Global 100 shares @ 155 with an investment of Rs. 15500

So portfolio as on 2nd Sep stands as:

Tata Global 100 shares -> 15,500

Cash -> 1,08,520 (Cash as on 25th July) + 61,700 (Cash from selling above stocks) - 15,500 (Cash utilized in buying fresh stock)= Rs. 1,54,720

Total Portfolio value including Cash and stocks at cost = Rs.1,70,220

****************************

Update as on 25th July 2014

****************************

****************************Utilizing the sharp fall in Cairn India and M&M Financial Services as they represent reasonable value at price points of 312 and 238 respectively

- Cairn India 100 @ 312 resulting in a investment of Rs. 31,200

- M&M Financial Services 100 @ 238 with an investment of Rs. 23800

- Cash -> Rs. 1,08,520

Update as on 23rd July 2014

****************************

Sold residual stocks (idea and IDFC) in the portfolio at profits leading to a 100% cash position to be deployed on weakness as and when it occurs.

- Idea Cellular sold 150 shares at 147 thereby generating profit of Rs. 450

- IDFC sold 100 shares at 160 thereby generating a profit of Rs. 2700

Updated Portfolio as on 23rd July 2014

Cash --> Rs. 1,63,520 (* Started this portfolio on 21st March 2013 with Rs. 1,00,000. Checkout the bottom of this page for datewise buy and sell in the portfolio).

****************************

Update as on 5th June 2014

****************************

Booking profits in stocks with good profits as the market is increasingly getting over stretched.

- PSB sold 300 shares at 80.50 thereby generating profit of Rs. 10,050 (Jackpot 71% return)

- M&M Fin sold 50 shares at 315 thereby generating a profit of Rs. 3450

- Dish TV sold 300 shares at 55 thereby generating a profit of Rs. 3000

- NTPC sold 100 shares at 164 thereby generating a profit of Rs. 4100

- Castrol sold 40 shares at 313 thereby generating a profit of Rs. 800

- Indian Hotels sold 150 shares at 95 thereby generating a profit of Rs. 3450

Total profits from the selling of above shares = Rs. 24,850

Updated Portfolio as on 5th June 2014

Idea Cellular 150 shares at 144 --> Rs. 21,600

IDFC 100 shares at 133 --> Rs. 13,300

Cash --> Rs. 1,25,470

Total Portfolio value at cost = Rs. 1,60,370 (Up > 60% since 21st March 2013)

****************************

Update as on 13th May 2014

****************************

Updated portfolio as on 13th May 2014 is as follows:

With exit polls out and most of them pointing towards stable NDA govt at the center, picking on some stocks which could participate in the post poll rally and are at the same time trading at reasonable valuations so that in case something goes wrong in next couple of months there is no major dent in the prices of such stocks.

- Punjab Sind Bank (PSB) 300 @ 47 resulting in a investment of Rs. 14100

- M&M Financial Services 50 @ 246 with an investment of Rs. 12300

- Dish TV 300 @ 45 with an investment of Rs. 13500

- Castrol India 40 shares @ 293, invstmt = Rs. 11720

- Indian Hotels 150 shares @ 72, invstmnt = Rs. 10800

- Cash = Rs. 25,900

|

Amit Agarwal's Model Portfolio (

As on

|

|||

|

Company

|

Qty

|

Purchase Price

|

Purchase Value

|

|

Idea

Cellular

|

150

|

144

|

21,600

|

|

IDFC

|

100

|

133

|

13,300

|

|

PSB

|

300

|

47

|

14,100

|

|

M&Mfin

|

50

|

246

|

12,300

|

|

Dish TV

|

300

|

45

|

13,500

|

|

Indian

Hotels

|

150

|

72

|

10,800

|

|

NTPC

|

100

|

123

|

12,300

|

|

Castrol

|

40

|

293

|

11,720

|

|

Cash

|

|

|

25,900

|

|

Total

|

135,520

|

||

****************************

Update as on 27th March 2014

****************************

Utilizing the sharp appreciation in market to encash some of the holdings of the portfolio:

Sold Bharti Airtel 30 shares @ 310 thereby generating a profit of Rs.750

Sold Union Bank 100 shares @ 122 thereby generating a profit of Rs.1200

Sold Dish TV 200 shares @ 52 thereby generating a profit of Rs.600

Sold Bajaj-Auto 8 shares at 2070 thereby generating a profit of Rs. 1320

As on 27th March 2014 day end the model portfolio had following stocks and cash:

Idea Cellular 150 @ 144 -> 21600

IDFC 100 @ 133 -> 13300

Cash = 52160 (Cash as on 21st march 2014) + 48460 (cash due to selling of above stocks)

-> 100620

Net portfolio value at cost -> Rs. 135520

Utilizing the sharp appreciation in market to encash some of the holdings of the portfolio:

Sold Bharti Airtel 30 shares @ 310 thereby generating a profit of Rs.750

Sold Union Bank 100 shares @ 122 thereby generating a profit of Rs.1200

Sold Dish TV 200 shares @ 52 thereby generating a profit of Rs.600

Sold Bajaj-Auto 8 shares at 2070 thereby generating a profit of Rs. 1320

As on 27th March 2014 day end the model portfolio had following stocks and cash:

Idea Cellular 150 @ 144 -> 21600

IDFC 100 @ 133 -> 13300

Cash = 52160 (Cash as on 21st march 2014) + 48460 (cash due to selling of above stocks)

-> 100620

Net portfolio value at cost -> Rs. 135520