IDBI Bank is governed under IDBI act which was amended in

1994 to allow 49% private ownership (as shown in the extract below taken from

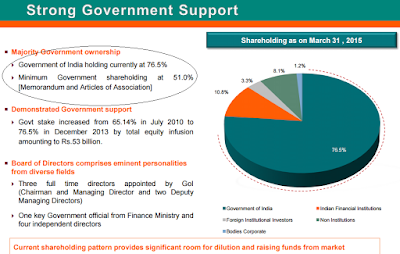

June 2015 investor presentation). As per Memorandum of Articles of Associations

minimum govt shareholding in the IDBI Bank has to be 51% (As shown in the

second shapshot taken from the presentation). Use the link in brackets to open June 2015 investor's presentation ( http://www.idbi.com/pdf/investor/IDBI_Investor_Presentation_June_2015.pdf)

|

| Snapshot1: IDBI Bank History |

|

| Snapshot2: IDBI Bank Govt of India Holding |

Finance Minister Mr Arun Jately comment on

making IDBI Bank similar to Axis Bank made the stock shoot up 17% in a day on

21st September 2015 with volume equivalent to 10% of the stocks free

float.

|

| IDBI bank Share Price went up 17% on 21st Sep 2015 |

Traders who had bought 65 call options previous day made a killing as the premium

went up from Rs.0.15 to 5.30 an appreciation of more than 3400% in a day.

Similarly 60 and 70 strike options also jumped 650% and 3800% respectively. But

is the bullishness justified? Can IDBI bank be privatized soon and become a

bank like Axis Bank? The answer to all the above questions, in my view, is no

mainly due to following reasons:

- IDBI repeal act under which IDBI was converted to bank might not have the clause that Govt. of India have to maintain 51% holding, but as per Memorandum of Articles of Associations minimum govt shareholding in the IDBI Bank has to be 51%.

- IDBI Act which is the original act under which IDBI was formed had the mandate of max 49% private ownership.

- As on June 2015, GOI held more than 75% in IDBI Bank which gives them room to dilute up to 51% but intention of diluting beyond 51% will meet huge opposition from bank associations and concerned entities. Even private appointments at some banks in August led to strikes and oppositions.

- IDBI Bank has been typically functioning as other public sector banks with huge amount of stressed assets and poor operating ratios, while Axis Bank is in a far superior condition as far as stressed assets and profits are concerned. Even if we assume that somehow GOI succeed in bringing down it’s shareholding in the bank to less than 51%, how will it solve the existing and ongoing problems of NPA which will continue to haunt the bank as majority of its loans are given to industrial & infra projects. As on 31st march 2015 the bank had a total restructured assets of over 20000 crores (up 30% over FY-14) which is almost 10% of its loan book making it among the top stressed banks in India. So why should it trade at significant premium to peers like Allahabad Bank, Corporation Banks, Bank of India, UCO Bank etc.

In my view investors should not get

trapped into such frenzy and enter the stock only for the long term as all the

talks of privatization and making it at par with Axis Bank (in terms of operations) is not going to

happen in next 3 years at least. Select Public Sector banks are good investment

opportunity as some of them are trading at less than their operating profit and

in some cases as low as one third of the book value. IDBI Bank is relatively

expensive compared to peer public sector banks. For example Bank of India which

is more than twice the size of IDBI bank is trading at lesser market value than

IDBI Bank. Similarly there are many PSBs having similar asset and operational profile trading at significant discount to IDBI Bank.

Note: Please read the disclaimer

at the bottom of this web page.

See their investment against their NPA.

ReplyDeleteYou are wrong Gov don't directly won shares in IDBI. Look share holding Lic and other insurance companies hold shares similar to axix bank.

ReplyDeleteSr. No

ReplyDelete(I) Name of the shareholder

(II) Details of Shares held Encumbered shares (*) Details of warrants Details of convertible securities Total shares (including underlying shares assuming full conversion of warrants and convertible securities) as a % of diluted share capital

No. of Shares held

(III) As a % of grand total (A) + (B) + (C)

(IV) No.

(V) As a percentage

(VI) = (V) / (III)* 100 As a % of grand total (A) + (B) + (C) of sub-clause (I)(a)

(VII) Number of warrants held

(VIII) As a % total number of warrants of the same class

(IX) Number of convertible securities held

(X) As a % total number of convertible securities of the same class

(XI) (XII)

1 Government of India 1227018622 76.50 0 0.00 0.00 0 0.00 0 0.00 77

Total 1227018622 76.50 0 0.00 0.00 0 0.00 0 0.00 77

Pls refer the promoters shareholding in the bank here: http://www.nseindia.com/corporates/corporateHome.html?id=spatterns&radio_btn=company¶m=IDBI