There are many free trading simulators for cash based buying and selling of stocks on virtual money and almost all the popular ones are good without having huge differences.

There are many free trading simulators for cash based buying and selling of stocks on virtual money and almost all the popular ones are good without having huge differences. But when it comes to Futures and Options (derivative) trading simulators there are not much choices and the virtual world in this space is pretty much occupied by following three.

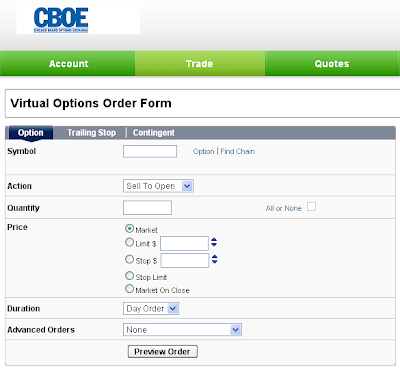

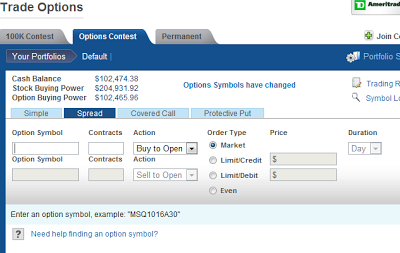

All three platforms are excellent but according to me the first prize goes to CBOE, the Chicago Board of Options Exchange for the sheer simplicity of the setup. Here you can virtually trade stocks, options, spreads, straddles,covered call trades and experiment with advanced order strategies like triggers and one-cancels-other (OCO). Investopedia and WSS also provide good derivatives trading simulator and are giving tough competition to the world's largest options exchange.

Understanding Buy to Open, Sell to Open, Buy to Close and Sell to Close

When you enter a trade, you are essentially opening a position, hence the orders "sell to open" and "buy to open." If you are buying an option, either a put or a call, you must enter a "buy to open" order. If you are writing an option, also referred to as selling an option, you must enter a "sell to open" order.

Now, to exit an order, you need to close your options position. If you bought an option, you need to use a "sell to close" order. If you wrote an option, you will need to use the "buy to close" order. In summary, a person holding a short position (contract writer) can sell to open (enter a contract) or buy to close (close a position). A person holding a long position (contract purchaser) can buy to open (enter a position) or sell to close (close a position).

No comments:

Post a Comment